Liberum Research's latest November executive turnover numbers were even more positive than the previous month of October and continued to point in a positive direction for the American economy. November's executive turnover numbers showed increases over last year's November figures in all four key categories Liberum analyzes for its monthly report (see details below). The executive turnover figures in November as compared to the previous month of October also showed positive increases in all four categories, something we have not seen for a long time and together indicates positively for the U.S. economy. The growing executive turnover numbers dovetailed directly with the positive employment growth numbers released last week by ADP for November and more importantly, the U.S. Government's Bureau of Labor Statistics (BLS) November Employment Report.

Typically, Liberum's monthly executive turnover figures tend to follow a similar pattern with the U.S. Government's Bureau of Labor Statistics' (BLS) Monthly Employment Report as well as ADP's Monthly Private Employment Report. The ADP and BLS November Reports exceeded expectations by most analysts and as a result, the Federal Reserve seems even more likely to begin raising interest rates slightly for the first time since the 2008 financial crisis. According to the ADP November Report:

ADP National Employment Report: Private Sector Employment Increased by217,000 Jobs from October to November according to the November ADP National Employment Report®"The strongest gains in the service sector since June led to greater employment growth in November,”said Ahu Yildirmaz, VP and head of the ADP Research Institute. “The increase was driven in large partby a rebound in professional/business service jobs.”Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth remains strong and steady. Thecurrent pace of job creation is twice that needed to absorb growth in the working age population. Theeconomy is fast approaching full employment and will be there no later than next summer.”

The employment news from the U.S. Government's Bureau of Labor Statistics (BLS) was very close to ADP's Employment Report. According to the November BLS Report:

Total nonfarm payroll employment increased by 211,000 in November, and the unemploymentrate was unchanged at 5.0 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in construction, professional and technical services, and healthcare.In November, the unemployment rate held at 5.0 percent, and the number of unemployed persons, at 7.9 million, was essentially unchanged. Over the past 12 months, theunemployment rate and the number of unemployed persons are down by 0.8 percentage point and 1.1 million, respectively.

Liberum expects the early winter months will continue to see the economy moving forward but, as we stated in the previous month and earlier months, with blips along the way. We continue to expect executive turnover numbers in the early winter months will also remain fairly positive. Overall, we remain positive for the American Economy despite the likelihood of a slight increase in interest rates from the Federal Reserve and continuing economic difficulties abroad.

Liberum Comparison Breakdown of Key November Executive Turnover Figures

Below is a breakdown of Liberum's key executive category percentage changes for November 2015 compared with November a year earlier and the previous month of October 2015.

November 2014 Compared to November 2015

- For November 2015 increases in turnover occurred in all four key categories. CEO changes increased 18% from November a year earlier, CFO changes increased 6%, C-level changes increased 37%, and board of director changes increased 44%, respectively.

October 2015 Compared to November 2015

- The month to month changes in executive turnover for all four key categories saw increases. CEO changes increased 28%, CFO changes increased 6%, C-level changes increased 9%, and board of director changes increased 14%.

Below are the overall turnover totals for November 2015. The information is just illustrative of how institutional investors could view executive turnover and its possible relationship with a company's performance. Using Liberum's database could offer a totally new perspective on investment and is a potential way to come up with unique special situation opportunities. Executive search firms can use the information to generate new leads and new clients, and consulting firms can use the data for a variety of analytical purposes.

Call now (212-988-5497) or email richard@twst.com and get a no obligation one week trial to Liberum's online management change database. Find out why Hedge Funds, Executive Search, Business Intelligence, and Consulting firms all rely on Liberum's data.

KEY CEO CHANGES - NOVEMBER 2015

55 COMPANIES WITH CEO CHANGES WORTH RE-EXAMINING

55 COMPANIES WITH CEO CHANGES WORTH RE-EXAMINING

According to Liberum's Management Change Database, a total of 250 CEO related changes occurred during November 2015. Here are 51 changes from the time period that caught my eye. By significant, I'm looking for situations where I think a particularly strong or weak choice has been made - given the apparent current state of the company - or where there is an interesting special situation. (Anyone using Liberum's database could do the same kind of analysis for other key titles, e.g., CFOs, COOs, CMOs, CIOs, Presidents, etc.)

DATE COMPANY TICKER EXCHANGE MARKET CAP $ MILLIONS

Change date Co name Ticker Market cap

11-02 Enteromedics Inc. ETRM NASDAQ 33

11-02 Intrum Justitia IJ STO 21170

11-02 Quest Resource Ho QRHC NASDAQ 85

11-03 Commerzbank CBK LONDON

11-03 DSW Inc. DSW NYSE 2180

11-03 Groupon, Inc. GRPN NASDAQ 2640

11-03 Kappahl KAHL STO 2370

11-03 Razor Resources Inc RZOR OTC 607830

11-04 Beijer Electronic BELE STO 1020

11-04 First Capital Bcp FCVA NASDAQ 73

11-04 Lumber Liquidator LL NYSE 420

11-05 Armistice Resourc AZ TORONTO 42

11-05 Wound Mgmt Tech WNDM OTC 7

11-09 E.I. du Pont de Nemours & Co DD NYSE 58520

11-09 Elementis ELM CVE

11-09 Loomis AB LOOMB STO

11-09 Santos SSLTY OTC 3710

11-09 XLI Technologies, Inc. MYXY 32

11-10 Jason Industries, Inc. JASN NASDAQ 84

11-12 Advance Auto Parts, Inc. AAP NYSE 12050

11-12 Connecture, Inc. CNXR NASDAQ 93

11-12 Entree Gold Inc. EGI NYSE 38

11-12 Platinum Group Me PLG NYSE 161

11-12 Sunshine Capital, Inc. SCNP OTC

11-13 La Quinta Holding LQ NYSE 1910

11-13 LDK Solar Co Ltd. LDKYQ OTC 20

11-16 CNA Financial Corporation CNA NYSE 9740

11-17 Akeena Solar, Inc WEST OTC 618197

11-17 Bob Evans Farms, Inc. BOBE NASDAQ

11-17 Elephant Talk Com ETAK NYSE 58

11-17 TiVo Inc. TIVO NASDAQ 893

11-17 Virtual Piggy, Inc VPIG OTC 38

11-18 Bridgeline Digital, Inc. BLIN NASDAQ 5

11-18 Intelligent Livin ILIV OTC 14019

11-18 Korian SA KORI EPA 2840

11-18 Pivot Pharmaceuticals Inc PVOTF OTC 98

11-19 Kalobios Pharmace KBIO UTC 75

11-19 Kemper Corporation KMPR NYSE 2110

11-19 Lantronix, Inc. LTRX NASDAQ 17

11-19 Markel Corporation MKL NYSE 12560

11-19 NBC Capital Corporation NBY 14

11-19 Portage Biotech Inc PTGEF OTC 33

11-20 Avalanche Biotechnologies Inc AAVL NASDAQ 186

11-23 Alfa Laval ALFALAVAL OTC

11-23 Global Healthcare GBCS OTC 16

11-23 TerraForm Global, Inc. GLBL NASDAQ 480

11-23 Truecar, Inc. TRUE NASDAQ 719

11-24 Akers Biosciences AKER NASDAQ 10

11-25 MannKind Corporation MNKD NASDAQ 896

11-27 Point Capital Inc PTCI OTC 85

11-30 Broadwind Energy, BWEN NASDAQ 30

NOVEMBER 2015 MANAGEMENT CHANGE STATISTICS

C-LEVEL MANAGEMENT CHANGE STATISTICS

GRAND TOTAL - 1,817

GRAND TOTAL - 1,817

TOP INDUSTRY SECTORS

> Drugs- 174> Banking - 161

> Energy - 143

> Energy - 143

NOVEMBER 2015 CEO CHANGE STATISTICS

GRAND TOTAL - 250

GRAND TOTAL - 250

TOP INDUSTRY SECTORS

> Drugs/Biotech - 20

> Energy- 20> Banking - 18

> Metals/Mining - 17

> Metals/Mining - 17

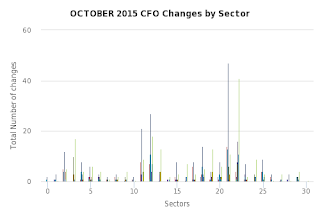

NOVEMBER 2015 CFO CHANGE STATISTICS

GRAND TOTAL - 223

GRAND TOTAL - 223

TOP INDUSTRY SECTORS

> Drugs/Biotech - 24

> Energy - 16

> Banking - 14

> Energy - 16

> Banking - 14

NOVEMBER 2015 BOARD OF DIRECTOR CHANGE STATISTICS

GRAND TOTAL - 550

GRAND TOTAL - 550

TOP INDUSTRY SECTORS

> Drugs/Biotech - 75

> Energy - 43

> Banking - 32

> Energy - 43

> Banking - 32

Investors need to diligently monitor key management changes. Certain management changes should be viewed as a "special situation" that can have a direct and major impact on a company's performance and share price.

- New CEOs know more than the market about the company. Their decision to take the position contains information. Likewise the departing CEO.

- Likewise departing CFOs New CFOs will bring new skills and often-times a new direction. This is normally significant, and worth analyzing.

Liberum Research, the independent research firm focused on corporate management change, has developed an online relational database designed to assist institutional investors develop special situation investment ideas related to executive management change. While special situation investing traditionally revolves around corporate restructuring, spin-offs, and acquisitions, executive management changes, depending on the circumstances, can represent a short or long-term investment opportunity.

Liberum's over ten-year-old database offers institutional investors the ability to examine:

- an individual company,

- sector/s,

- corporate titles

- groups of companies,

- market caps

- and/or geographic region/s/ locations via a metric of one's own choosing.

- you can use the information individually or in combination with a number of other financial tools to develop unique investment ideas.