Friday, March 28, 2008

Update - Electronic Arts - CFO Change in Midst of Take Two Hostile Takeover Attempt

Thursday, March 27, 2008

Recommended Reading - Motorola To Split in Two - Who Might Run the Mobile Phone Business?

Tuesday, March 25, 2008

Update to Ford Announces Six Internal Candidates As Successor to Mulally

It is rare that we see things change so quickly at one of the top American automobile manufacturers. It is possible that Mulally forced Laymon out after the story he leaked left the impression that Mullaly might be a lame duck.

There may be more to this story, stay tuned.

More:

CNN Money

Morningstar

Recommended Reading - Ford Announces Six Candidates As Mulally's Future Successor

- Lewis Booth, EVP in charge of Europe and Premier Automotive Group

- Jim Farley - Group VP of marketing and communications

- Mark Fields - President of the Americas

- Joe Heinricks - Group VP of global manufacturing

- Don Leclair - CFO

- Stephen Odell - COO Ford of Europe

Immediately, the company went into panic mode.

"I'm not going to go there," said one of the purported candidates, Americas boss Mark Fields, when Automotive News asked him about the report. "I'm going to let the chips fall where they may."

Laymon's untimely disclosure will have the following negative effects on the company:

... It immediately sets up a horse race among the six candidates that could create unnecessary conflict and backbiting. Ford has a history of corporate infighting going back decades (Harry Bennett and Henry Ford II, Henry Ford II and Lee Iacocca, Bill Ford and Jac Nasser) and hardly needs any more of it.

It immediately makes Mulally a lame duck, even though his contract doesn't expire until 2011. Scuttlebutt around the copy machine will now focus more on who will replace Mulally than what Mulally himself is trying to accomplish.

Stay tuned to see how the company manages to handle this messy announcement.

For more:Autoblog

Monday, March 24, 2008

Electronic Arts in Midst of Hostile Takeover Jettisons CFO

ng to many analysts the driving force behind EA's controversial hostile takeover attempt of software gaming firm Take-Two, appears to be consolidating his control and management approach to the firm. In a surprise announcement, EA's CFO Warren Jensen, who has had the position since 2002, announced he would be resigning. Jensen's resignation comes shortly after another major change in top management took place recently (appointment of new president and COO). The company provided no specific reason for the CFO change. In the company's press release Jensen said,

ng to many analysts the driving force behind EA's controversial hostile takeover attempt of software gaming firm Take-Two, appears to be consolidating his control and management approach to the firm. In a surprise announcement, EA's CFO Warren Jensen, who has had the position since 2002, announced he would be resigning. Jensen's resignation comes shortly after another major change in top management took place recently (appointment of new president and COO). The company provided no specific reason for the CFO change. In the company's press release Jensen said,“It’s time for me to write the next chapter in my career – and I wish EA the best in the dynamic period ahead.”Jensen's exit comes at a strange point in the company's circumstances, the hostile takeover bid for Take-Two. While only speculation on my part, Riccitiello who finds himself under increasing pressure as corporate profits continue to remain weak and his takeover bid of Take-Two which has turned hostile has up to this point failed to succeed. He has felt the need to revamp top management to meet his own specific requirements and make certain his underlings remain beholden to him. According to Mark Bruno in Financial Week analyst Doug Creutz of Cowen & Co. said,

it’s likely Mr. Riccitiello—who returned to EA early last year after co-founding venture capital firm Elevation Partners—is simply looking to place his own people on the video game company’s management team. “[Mr. Riccitiello]’s been back for a year now and he may be looking for someone with a different point of view,” said Mr. Creutz. “Jenson was a well-regarded CFO, but Riccitiello may be after someone with more of an innovator’s mind-set.”It is difficult to figure how this specific management change at this juncture in the company's business makes sense. We will just have to wait and see what transpires with the hostile bid and the company's plans for the future. As it stands for the moment Jensen will remain with the firm for a number of months, so we can assume he still could be helpful with the takeover bid. According to a story in the Financial Times,

...Riccitiello has made several management changes since he succeeded Larry Probst as chief executive a year ago. He has reorganised the company into four different “labels” with separate heads and this month appointed a chief operating officer, John Pleasants, to lead the company’s global publishing operations.We will just have to wait and see.

Stay tuned.

For more:

Spong

Paidcontent.org

Reuters

Financial Times

Venturebeat

Business Journal

The Escapist

Ars Technica

Thursday, March 20, 2008

Midway Games Zaps CEO

served in a top position at Walt Disney. The company's press release earlier today only mentioned that an interim CEO, Matthew V. Booty, was appointed. Booty had been the SVP for the company's Worldwide Studios. The company press release made no specific reference to Zucker.

served in a top position at Walt Disney. The company's press release earlier today only mentioned that an interim CEO, Matthew V. Booty, was appointed. Booty had been the SVP for the company's Worldwide Studios. The company press release made no specific reference to Zucker.Midway Games Inc. (NYSE: MWY) today announced that Matthew V. Booty has been named Interim Chief Executive Officer and President, and that the company's Board of Directors has commenced a search for a new Chief Executive Officer and President.

"Dynamic new leadership is needed to bring Midway to its full potential," said Shari Redstone, Chair of the Board. "I believe that Midway has the resources and creative capability to once again be competitive with the best in the videogame business. The Board is confident that a new CEO will be selected who can fully utilize the opportunities presented by this next-generation console cycle to renew Midway's position as a major player in the videogame industry."

Wednesday, March 19, 2008

Recommended Reading - Target's inner circle - Fortune

...Ulrich has transformed a Midwestern discounter into one of the most admired and imitated companies in the world. Target now ranks 33rd on the Fortune 500 - making it bigger than Microsoft, Pfizer, and PepsiCo, and more than double the size of Cisco Systems....Though everyone knows Target (TGT, Fortune 500), hardly anyone's even heard of Ulrich. ...Even Ulrich's own employees often don't recognize him during his twice-monthly store walks, when he strolls the aisles dressed in Target's standard red shirt and khakis. Neither he nor his company has ever before graced the cover of a major magazine - highly unusual for a corporation its size. In fact, Ulrich has deliberately stayed so far under the radar that Bob Thacker, a former Target marketing executive now at OfficeMax, dubbed him the "silent Sam Walton." Says Thacker: "He has no public persona."

In a world of high profile CEOs, Ulrich's approach is refreshing and overall has been quite successful.

Check it out.Monday, March 17, 2008

Motorola Continues to Re-shape Management

The company (Motorola) is bringing in a private equity executive to be treasurer. It is also replacing the head of its Europe, Middle East and Africa cell phone operations. According to The Wall Street Journal the company said "the leadership changes are part of an overall plan to swiftly transform the senior executive team."It is difficult to assess what all these changes will mean for the company going forward.

Motorola has been trying, unsuccessfully, to sell its handset division, probably to a rival like Samsung. It now appears that the firm will have to work its way out of trouble. That means that executives in areas where the company is doing poorly could all be out in the next several months.

For more:

Chicago Tribune

EDN

Wireless Week

CNET News Blog

Endgadget

Thursday, March 13, 2008

Union Backed Investment Firm Seeks De-linkage of CEO/Chairman Post At Morgan Stanley

In a letter, the CtW Investment Group urged votes against Mr. Mack, Howard Davies and Robert Kidder, each of whom has been nominated for re-election. The letter said Messrs. Davies and Kidder acquiesced in allowing Mr. Mack to radically increase the company's risk-taking shortly after he took the top job at Morgan Stanley.Mack is fighting to resist the calls of CtW but the reeling credit crisis may work in the union backed asset management firm's favor."As members of the Board's audit committee in fall 2005, we believe that directors Davies and Kidder failed to maintain the integrity of Morgan Stanley's risk management, and thus bear central responsibility for the firm's $9.4 billion in subprime-related write-downs in 2007," the letter said.

Stay tuned for the April 8th annual meeting.

For more:

MarketWatch 3/22

Portfolio.com 3/14

Sealy Corporation Undergoes Major Management Changes

The management changes come as Sealy's performance and sales have been s

uffering in conjunction with the continuing decline in housing and the overall softening of the economy. It is expected that Sealy will seriously examine its overall strategic approach to its business as the company continues to see slowing growth, particularly in its North American marketplace. Sealy was formerly owned by investment firm Bain Capital. In 2004 the firm was bought by KKR. In 2005, the company filed an IPO and began trading in March 2006. Since going public the company has been expanding its US operations, it is possible that focus may shift. Sealy continues to maintain a strong market position as compared with its competitors. Its size has afforded the firm the ability to operate a large scale operation that controls virtually all phases of production, a situation that does not apply to its competitors.

uffering in conjunction with the continuing decline in housing and the overall softening of the economy. It is expected that Sealy will seriously examine its overall strategic approach to its business as the company continues to see slowing growth, particularly in its North American marketplace. Sealy was formerly owned by investment firm Bain Capital. In 2004 the firm was bought by KKR. In 2005, the company filed an IPO and began trading in March 2006. Since going public the company has been expanding its US operations, it is possible that focus may shift. Sealy continues to maintain a strong market position as compared with its competitors. Its size has afforded the firm the ability to operate a large scale operation that controls virtually all phases of production, a situation that does not apply to its competitors.Keep a very close eye on the moves the company takes for the next few months. It is likely that Norris will play a very important role in the next steps the company takes and will be very important in the ongoing CEO selection process.

Stay tuned.

For more:

Furniture Today 3/24

Reuters

Furniture Today

Yahoo

Monday, March 10, 2008

Online Jewelry Company, Blue Nile See Another CFO Turnover

ill become effective March 31 "to pursue other interests." Back in June, Scott Devitt, who served as Managing Director and Senior Analyst, Internet Consumer Services at Stifel Nicolaus & Co., was named chief financial officer. Shortly after his appointment, Devitt cited personal reasons and turned down the job.

ill become effective March 31 "to pursue other interests." Back in June, Scott Devitt, who served as Managing Director and Senior Analyst, Internet Consumer Services at Stifel Nicolaus & Co., was named chief financial officer. Shortly after his appointment, Devitt cited personal reasons and turned down the job.Easton's latest resignation according to an AP story in the Houston Chronicle comes while,

Blue Nile shares dropped $3.01, or 7.2 percent, to $38.95 in morning trading. In the past year, the stock has traded between $38.21 and $106.16.The company has been floundering as the retail environment continues to remain challenging. Keep a close eye on how Blue Nile manages to handle this type of dysfunction.

For more:

Businessweek

Puget Sound Business Journal

Recommended Reading - When Bad People Rise to the Top, MIT Sloan Management Review, Winter 2008

Mr. Leap lists a dozen warning signs that boards should be looking for, and they include:The article is definitely worth reading.

An obsession with acquiring prestige, power and wealth.” This, coupled with an inability to delay gratification, suggests that a chief executive may put his interests ahead of the company’s.A reputation for shameless self-promotion and other self-aggrandizing behaviors.”

A tendency to create “grandiose strategies” without including a detailed plan for how they will be carried out.

The ability to compartmentalize and rationalize to an amazing degree. This trait, Mr. Leap writes, is shared by dysfunctional people, among them bad chief executives and criminals. Clearly, even the best chief executives occasionally exhibit some of these traits. “Potentially bad C.E.O.s, however, usually possess several of these characteristics and they exhibit them repeatedly,” he writes.

Mr. Leap says his message to corporate boards is simple: in the late stages of the selection process, spare no expense in digging deeply into a finalist’s background.

Friday, March 7, 2008

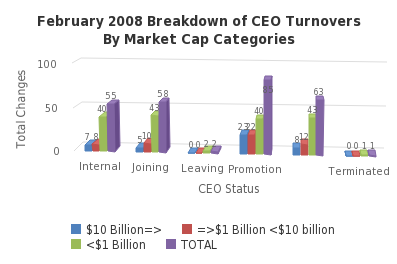

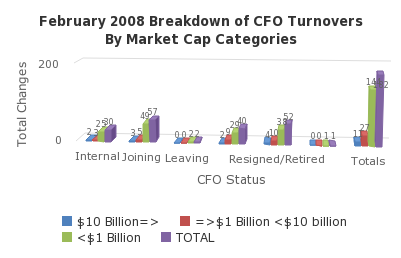

February CEO & CFO Changes Jump

Recommended Reading - WaMu Board Protects Bonus Compensation of Top Execs

shington D.C. (today's hearings on C-Span) according to story in Reuters Washington Mutual's WM (NYSE) Board of Directors earlier this week defied the growing resentment over executive pay and,

shington D.C. (today's hearings on C-Span) according to story in Reuters Washington Mutual's WM (NYSE) Board of Directors earlier this week defied the growing resentment over executive pay and,approved a plan which helps protect its management's bonus targets from the impact of the subprime loan fallout, according to a filing with U.S. regulators.

... The filing, made with the Securities and Exchange Commission on Monday, refers to targets for WaMu chief executive Kerry Killinger, chief financial officer Thomas Casey, chief operating officer Stephen Rotella, and retail banking chief James Corcoran.The board's committee said in light of the challenging business environment and the need to evaluate performance across a wide range of factors it will take a three-step approach to rewarding its executives including subjectively evaluating company performance in credit risk management.

Boards need to at least face reality in today's market and try make sound judgments. It does not appear that WaMu's board succeeded in this circumstance. Will their filing stand? Stay tuned.

For more:Financial Week 3/10

Thursday, March 6, 2008

Management Changes At Motorola Continue, CMO Out

Motorola confirmed Thursday that Kenneth "Casey" Keller, who had been marketing chief since October 2006, departed the company on Feb. 29. The company is not replacing him. Instead, Keller's two former deputies, Eduardo Conrado and Jeremy Dale, will now report directly to the presidents of their divisions.The confirmation comes just after it became known that activist shareholder and major Motorola critic, Carl Icahn, increased his ownership of Motorola shares from 5% to over 6%. Pressures continue to build from a number of fronts on Motorola's newest CEO, Greg Brown, as he tries to find a formula to right the ship.

... Motorola is searching for a new mobile devices head and is conducting a broad restructuring that could involve splitting the handset division from its other businesses.

Keep a close eye on the company and moves taken by the CEO and Ichan.

For more:

BloggingStocks 3/7

New CFO at Bristol Myers Squibb May Mean Changes

The change which will take place on March 31 and comes one month after the pharmaceutical company reported an ‘impairment charge’ of $275m in auction rate securities, consisting in part of sub-prime mortgages for the fourth quarter, according to CFO.com.Prior to joining Bristol-Myers Squibb, Huet served as chief financial officer at Royal Numico N.V. in Amsterdam. Before working at Royal Numico he was an executive director, Investment Banking Services, at Goldman Sachs International in London. Huet's appointment comes at the same time the firm also promoted Lamberto Andreotti to Chief Operating Officer. The management changes indicate something is happening at the firm.

Huet is known as a deal maker and is expected to work well with Bristol-Myers Chairman and CEO, James M. Cornelius. His appointment may be an indication that Bristol Myers is getting ready to do some acquisitions or looking to get itself acquired. Chris Kaufman of Reuters Deal Zone wrote a blog March 5th entitled, A Deal Maker for BMY in which he stated,

Huet’s M&A experience would fit well with that of Chief Executive James Cornelius who took the top spot last April. Cornelius had been chairman of medical device maker Guidant, and spearheaded its sale for $27 billion to Boston Scientific Corp just months before assuming his interim leadership role at Bristol. Bristol-Myers saw some divestment activity in December, announcing plans to sell its medical imaging business for $525 million to a private equity group as part of an effort to focus on its higher-profit prescription medicines, and has embarked on a major restructuring that will eliminate 10 percent of its work force and close more than half its factories over the next three years.Keep a close eye on Bristol-Myers Squibb and particularly Jean-Marc Huet.

Wednesday, March 5, 2008

Atari Gets Major Boost With Phil Harrison Appointment

y resigned with great media fanfare as president of Sony Computer Entertainment's Worldwide Studio is now the new president of Infogrames Entertainment (Atari). Harrison will report directly to new CEO, David Gardner, who himself was hired away recently from Electronic Arts to become Atari's new CEO. According to a blog story by Marcus Yam for Daily Tech he pointed out Harrison said,

y resigned with great media fanfare as president of Sony Computer Entertainment's Worldwide Studio is now the new president of Infogrames Entertainment (Atari). Harrison will report directly to new CEO, David Gardner, who himself was hired away recently from Electronic Arts to become Atari's new CEO. According to a blog story by Marcus Yam for Daily Tech he pointed out Harrison said,"This is the perfect time to join Infogrames and help shape the future of Atari - one of the industry's legendary brands," ... "As the game business moves rapidly online I believe we have an outstanding opportunity to create amazing network game and community experiences for players the world over."Infogrames in a statement said,

Harrison, one of the founding members of the PlayStation team at Sony, will "grow the Atari brand into a leading online game company." His duties will be similar to his last position within Sony: Overseeing game development studios both internal and external while "attracting world-class design and development talent" to Atari.Atari which has been facing serious problems on the NASDAQ exchange is starting to make product development waves. There might be something to them.

Stay tuned.

For more:

Silicon Alley 3/7

Press Release 3/6

NY Times DealBook 3/7

CEO Watch List - Rick Wagoner, GM, Update 2

Chief Executive Rick Wagoner will spend more time lobbying and traveling now that Frederick "Fritz" Henderson, the auto maker's current chief financial officer, has been promoted to chief operating officer.If you look at the change more closely one might interpret Henderson's promotion as way to dilute Wagoner's power and actually push him upstairs. That is the way I interpret the promotion and is also the same take that Douglas McIntyre who wrote a piece in today's Bloggingstocks. According to McIntyre,Mr. Wagoner, speaking to a small group of reporters at the Geneva Motor Show, declined to say whether Mr. Henderson was being groomed for the auto maker's top job and stressed that the shuffling in executive ranks wasn't a reaction to GM's recent struggles. The promotion was "something I'd been thinking about for a while and talking to the board [of directors] about," Mr. Wagoner said.

... Mr. Wagoner, 55, said GM's top ranks had been "stretched" and that he will now be able to focus on other pressing issues facing the auto maker while Mr. Henderson focuses on more day-to-day concerns, such as maintaining the company's evolving global structure. Mr. Wagoner pointed to lobbying on environmental regulations and spending more time in fast-growing emerging markets as key priorities amid his new lighter workload.

General Motors' (NYSE: GM) CEO Rick Wagoner has been kicked upstairs [subscription required], according to the Wall Street Journal. He will focus on international expansion and advanced technology. Not much of a job for a chief executive. Frederick Henderson will take over as COO and run the company's daily operation.I plan to keep Wagoner on my watch list but there already appears to be a change at GM. Stay tuned.

Wagoner's sin was that he could not launch products that would get GM back some of its market share in the U.S. He was able to cut costs and get an improved deal with the UAW, but GM's January sales were down over 12% in its home market. Its share in America is only about 25%. Toyota (NYSE: TM) has muscled GM out of its lead in small and mid-sized cars.

For Update information see:

Financial Week 3/10

Lansing State Journal 3/6

Monday, March 3, 2008

Gap CEO Continues to Show Promise - Update 2

Back when Murphy was first appointed in July of last year, many analysts raised doubts on his selection due to his lack of retail clothing expertise, I on the other hand was quite positive about the selection. While it was true, Murphy had little retail clothing expertise, he managed in his previous position as CEO of Shoppers Drug Mart in Canada to demonstrate an uncanny talent for running a successful business that relied on merchandising and retail expertise. Murphy still has a long way to go with the Gap, especially in this difficult retail environment, but he deserves praise for his efforts and results so far.

Stay tuned.

For more:

Investopedia