Liberum Research's latest October executive turnover numbers continued to point in a positive direction for the American ecoonomy. October's executive turnover numbers showed increases over last year's October figures in three out of four key categories Liberum analyzes for its monthly report (see details below). The executive turnover figures in October as compared to the previous month of September, on the other hand, were not nearly as positive, three out of the four categories saw declines, while the remaining category saw a slight increase. Despite the middling numbers, we remain optimistic about the economy, overall employment growth, and continuing turnover at public companies.

Typically, Liberum's monthly executive turnover figures tend to follow a similar pattern with the U.S. Government's Bureau of Labor Statistics' (BLS) Monthly Employment Report as well as ADP's Monthly Private Employment Report. The government's employment figures for October will be released this coming Friday, November 6, and Liberum expects them to be better than September's revised figures. Earlier today, ADP released its October 2015 Employment Report and while it was not terrific, it was on target with analyst's expectations. According to the Report:

Private sector employment increased by 182,000 jobs from September to October."Firm size contributions to October employment gains returned to the same pattern we had been seeing for some time prior to September as small businesses rebounded to account for almost half the jobs added,” said Ahu Yildirmaz, VP and head of the ADP Research Institute. “Large companies continue to be negatively impacted by trends such as low oil prices and the strong dollar driving weaker exports. On the other hand, small businesses can benefit from these same trends.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth as measured by the ADP Research Institute is not slowing meaningfully in contrast with the recent slowdown in the government’s data. The economy is creating close to 200,000 jobs per month. Job gains are broad based with energy and manufacturing alone subtracting from the top line. Small businesses, in particular, are contributing to the labor market’s solid performance.”

Liberum expects the remaining fall months will continue to see the economy moving forward but, as we stated in the previous month, with blips along the way. We continue to expect excecutive turnover numbers in the fall and early winter months will also remain fairly positive. Overall, we remain quite positive for the American Economy despite the likelihood of a slight increase in interest rates from the Federal Reserve, possibly in December, and contiuing economic difficulties abroad.

Liberum Comparison Breakdown of Key October Executive Turnover Figures

Below is a breakdown of Liberum's key executive category percentage changes for October 2015 compared with October a year earlier and the previous month of September 2015.

October 2014 Compared to October 2015

- For October 2015 increases in turnover occured in three out of four key categories. CEO changes decreased 8% from October a year earlier, while CFO changes increased 10%, C-level changes increased a 18%, and board of director changes increased 6% respectively.

September 2015 Compared to October 2015

- The month to month changes in executive turnover for three out of the four key categories, on the other hand, were characterized by declines. CEO changes declined 3%, CFO changes increased 3%, C-level changes declined 11%, and board of director changes declined 19%.

Below are the overall turnover totals for October 2015. The information is just illustrative of how institutional investors could view executive turnover and its possible relationship with a company's performance.

Call now (212-988-5497) or email richard@twst.com and get a no obligation one week trial to Liberum's online management change database. Find out why Hedge Funds, Executive Search, Business Intelligence, and Consulting firms all rely on Liberum's data.

KEY CEO CHANGES - OCTOBER 2015

55 COMPANIES WITH CEO CHANGES WORTH RE-EXAMINING

55 COMPANIES WITH CEO CHANGES WORTH RE-EXAMINING

According to Liberum's Management Change Database, a total of 195 CEO related changes occurred during October 2015. Here are 55 changes from the time period that caught my eye. By significant, I'm looking for situations where I think a particularly strong or weak choice has been made - given the apparent current state of the company - or where there is an interesting special situation. (Anyone using Liberum's database could do the same kind of analysis for other key titles, e.g., CFOs, COOs, CMOs, CIOs, Presidents, etc.)

DATE COMPANY TICKER EXCHANGE MARKET CAP $ MILLIONS

10-01 Autobytel Inc. ABTL NASDAQ 212

10-01 Jamba, Inc. JMBA NASDAQ 223

10-01 Puget Technologie PUGE OTC 463159

10-01 SUPERVALU INC. SVU NYSE 1850

10-01 Travelzoo Inc. TZOO NASDAQ 122

10-01 TV Azteca AZTEF OTC 448

10-01 XenoPort, Inc. XNPT NASDAQ 220

10-02 Altair Nanotechnologies, Inc. ALTI OTC 2

10-02 Majesco Entertainment Co. COOL NASDAQ

10-02 Pharmacyte Biotech PMCB OTC 66

10-05 Arena Pharmaceuticals, Inc. ARNA NASDAQ 521

10-05 Cardica, Inc. CRDC NASDAQ 23

10-05 E.I. du Pont de Nemours & Company DD NYSE 46400

10-05 Jayhawk Energy In JYHW OTC 1

10-05 Kulicke and Soffa Industries Inc. KLIC NASDAQ 686

10-05 SmartChase Corp SCHS OTC 3

10-05 Tweeter Home Entertainment Group, Inc. TWTR NYSE 18450

10-13 Barclays PLC (ADR) BCS NYSE 55010

10-13 Fastenal Company FAST NASDAQ 11070

10-13 The Carlyle Group CG NASDAQ 1520

10-14 Famous Brands Ltd F5B BEB

10-14 Great Lakes Dredg GLDD NASDAQ 323

10-14 Imation Corp. IMN NYSE 85

10-15 Go Green Global T GOGR OTC 3

10-15 Terex Corporation TEX NYSE 2010

10-19 21vianet Group, I VNET NASDAQ 1760

10-19 Biotime, Inc. Com BTX NYSE 316

10-19 Eutelsat Communications SA ETL WARSAW

10-19 Investment Technology Group ITG NYSE 517

10-19 The Hanover Insurance Group, Inc. THG NYSE 3610

10-19 United Continental Holdings Inc. UAL NYSE 21440

10-20 Aladdin International Inc. ALAD OTC 3

10-20 Exar Corporation EXAR NYSE 265

10-20 Syngenta AG (ADR) SYT NYSE 31750

10-21 National Cinemedi NCMI NASDAQ 814

10-21 Volt Info Sci Inc VISI NYSE 172

10-22 420 Property Management, Inc. DOGOD 107040

10-22 Debenhams DEB LONDON 11

10-22 KapStone Paper and Packaging Corp KS NYSE 1970

10-22 Platform Specialty Products Corp PAH NYSE 2170

10-22 Vince Holding Corp. VNCE NYSE 174

10-22 Wall Street Media Co, Inc. WSCO OTC 27

10-23 Infosys INFY NYSE 42510

10-23 News Corporation NWSA NASDAQ 8710

10-23 Paradox Entertainment AB PDXE SWEDEN 33

10-26 alpha-En Corp ALPE OTC 12

10-26 Cdex Inc Cl ACDEX OTC 374679

10-26 Northsight Capital Inc. NCAP OTC 10

10-26 Penn Virginia Corporation PVA NYSE 47

10-26 Standard Metals Processing Inc SMPR OTC 16

10-27 DS Healthcare Group Inc DSKX NYSE 58

10-27 LVMH Moet Hennessy Louis Vuitton SE LVMHF OTC 93370

10-28 Baxter International Inc. BAX NYSE 20320

10-28 Chico's FAS, Inc. CHS NYSE 1960

10-28 UBS AG (USA) UBS NYSE 74440

OCTOBER 2015 MANAGEMENT CHANGE STATISTICS

C-LEVEL MANAGEMENT CHANGE STATISTICS

GRAND TOTAL - 1670

GRAND TOTAL - 1670

TOP INDUSTRY SECTORS

OCTOBER 2015 CEO CHANGE STATISTICS

GRAND TOTAL - 195

TOP INDUSTRY SECTORS

> Drugs/Biotech - 18

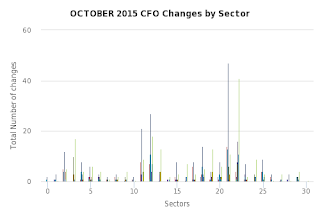

OCTOBER 2015 CFO CHANGE STATISTICS

GRAND TOTAL - 211

TOP INDUSTRY SECTORS

OCTOBER 2015 BOARD OF DIRECTOR CHANGE STATISTICS

GRAND TOTAL - 481

TOP INDUSTRY SECTORS

Investors need to diligently monitor key management changes. Certain management changes should be viewed as a "special situation" that can have a direct and major impact on a company's performance and share price.

- New CEOs know more than the market about the company. Their decision to take the position contains information. Likewise the departing CEO.

- Likewise departing CFOs New CFOs will bring new skills and often-times a new direction. This is normally significant, and worth analyzing.

Liberum Research, the independent research firm focused on corporate management change, has developed an online relational database designed to assist institutional investors develop special situation investment ideas related to executive management change. While special situation investing traditionally revolves around corporate restructuring, spin-offs and acquisitions, executive management changes, depending on the circumstances, can represent a short or long-term investment opportunity.

Liberum's over ten year old database offers institutional investors the ability to examine:

- an individual company,

- sector/s,

- corporate titles

- groups of companies,

- market caps

- and/or geographic region/s/ locations via a metric of one's own choosing.

- you can use the information individually or in combination with a number of other financial tools to develop unique investment ideas.

No comments:

Post a Comment