Thursday, May 29, 2008

Recommended Reading - Lessons of the fall, Ex-CEOs from JetBlue, Starbucks, and Motorola discuss what they learned when they lost their jobs

Patricia Sellers, an editor at large for Fortune, wrote a piece based on the insights of three high-level CEOs that were forced to resign. The interviews and analysis are a worthwhile read.

Activist Shareholders Impact A French Firm For First Time

France finds itself added to the list of European countries where activist shareholders can have an impact. Atos Origin S.A. ATO (Paris Exchange), provider of information technology systems and services, succumbed the other day to growing pressures from activist shareholders. After resisting increasing pressures for a number of months from Pardus Ca pital Management and Centaurus Capital Ltd., who happened to be the company's two largest shareholders, the company agreed to parts of their requests. The activist funds were insisting the company make changes to its corporate strategy and management. According to a story by Geraldine Amiel for The Wall Street Journal,

pital Management and Centaurus Capital Ltd., who happened to be the company's two largest shareholders, the company agreed to parts of their requests. The activist funds were insisting the company make changes to its corporate strategy and management. According to a story by Geraldine Amiel for The Wall Street Journal,

pital Management and Centaurus Capital Ltd., who happened to be the company's two largest shareholders, the company agreed to parts of their requests. The activist funds were insisting the company make changes to its corporate strategy and management. According to a story by Geraldine Amiel for The Wall Street Journal,

pital Management and Centaurus Capital Ltd., who happened to be the company's two largest shareholders, the company agreed to parts of their requests. The activist funds were insisting the company make changes to its corporate strategy and management. According to a story by Geraldine Amiel for The Wall Street Journal,In a joint statement, Atos and the funds said they reached an agreement over management and other issues "in the best interest of the company, its employees, its clients, and all stakeholders."

• What's New: Atos Origin reached agreement with two funds on management and strategic shifts as Chairman Didier Cherpitel stepped down.• The Background: The funds, Centaurus Capital and Pardus Capital, will each gain a board seat at the IT-services concern:• What's Next: Not a breakup, Centaurus and Pardus say.Pardus and Centaurus, which hold a combined stake of more than 23% in the French information-technology-services company, have been at loggerheads with management for months and have been seeking to oust Mr. Cherpitel and nominate their own candidates to the supervisory board.

The company agreed to select Jean-Phillippe Thiery, the chairman and CEO of the French insurer AGF, as chairman and replacement for Didier Cherpitel. Before the agreement came about a chaotic spectacle took place where accusations were flying between the two camps. According to a Reuters story by Dominque Vidalon,

Speaking at a news conference held jointly with his former tormentors, Atos's chief executive, Philippe Germond, said the funds had promised not to push for a break-up of the 11-year-old firm. He reiterated he would look at a merger offer if one arrived.He said both sides regretted the chaotic scenes at last Thursday's shareholder meeting, in which the meeting hall's power was cut off to prevent the funds from pressing for a vote."The management and the funds fully realised that our disagreements were compromising the smooth running of Atos. That's why we chose to enter discussions and I assure you today that all the parties are extremely sorry," he said.

Expect more pressures on French firms as activist shareholders look to make more changes. Keep a close eye on Atos Origin to determine whether the recent changes make a difference.

For more:

Friday, May 23, 2008

Update: Heely's New CEO Takes Helm

Heelys HLYS (NASDAQ), the wheeled sneaker manufacturer who hit a wall after its fad began to waiver, has put in place a new CEO, Don Carroll. Back in February, Heelys' CEO Michael Staffaroni resigned (see earlier blog) as the company's fortunes continued to sink. Upon Staffaroni's resignation the company appointed Ralph T. Parks, who at the time had been recently appointed to the company's board. Parks will remain a member of the board now that Carroll is the new CEO.

Carroll originally joined Heelys back in early January when he was appointed SVP of Marketing. While Carroll appears to have over twenty years of consumer product experience, at first glance he does not bring anything extraordinary to the table. For the last two years he was a managing director at Vector2group, a professional services company intended to drive operational improvements in companies. Prior to Vector2group he worked for Radio Shack for eight years. His last position at the company he was the SVP Marketing and Brand Officer. While all these positions were useful, what do they offer for a company reeling from falling sales and need for a major strategic re-focus? According to a piece in the Advertiser, Carroll is quoted,

... he's got big brand-revival plans. Within five years, its wheeled shoes that generate 100 percent of sales will account for just 30 percent to 35 percent, he projects.

While the company and Carroll have product plans he has a tough task ahead.

Stay tuned.

For more:

Labels:

Don Carroll,

Heelys,

Michael G. Staffaroni,

New CEO,

Ralph T. Parks

Wednesday, May 21, 2008

Sonus Networks Brings in New CEO From Motorola

Sonus Networks SONS (NASDAQ), the market leader in IP communications infrastructure, has made a major change at the top. After ten years leading Sonus Networks as both CEO and chairman, Hassan Ahmed has given up his CEO position but will remain the company's chairman. The company has selected Richard Nottenburg, PhD., the former Motorola Inc. vice president and chief strategy and technology officer. Nottenburg leaves Mo torola in the midst of continuing management turnover at the top as new CEO Greg Brown works to re-right the floundering Motorola ship. Nottenberg may turn out to be a real coup for Sonus. Both his background and experience may bode well for the firm.

torola in the midst of continuing management turnover at the top as new CEO Greg Brown works to re-right the floundering Motorola ship. Nottenberg may turn out to be a real coup for Sonus. Both his background and experience may bode well for the firm.

Nottenberg holds three degrees in electrical engineering, including a doctorate from the Ecole Polytechnique Federale de Lausanne, a master's degree from Colorado State University and a bachelor's degree from Polytechnic University of New York . He originally came to Motorola in 2004. According to a story in Mass High Tech,

Sonus continues to perform reasonably well. It's latest first quarter results which took place in a difficult market were better than acceptable.

Keep a close eye on his first six month decisions and business moves. Be assured that Hassan Ahmed will be watching closely.

For more:

Chicago Business

Techland

TMC Net

torola in the midst of continuing management turnover at the top as new CEO Greg Brown works to re-right the floundering Motorola ship. Nottenberg may turn out to be a real coup for Sonus. Both his background and experience may bode well for the firm.

torola in the midst of continuing management turnover at the top as new CEO Greg Brown works to re-right the floundering Motorola ship. Nottenberg may turn out to be a real coup for Sonus. Both his background and experience may bode well for the firm.Nottenberg holds three degrees in electrical engineering, including a doctorate from the Ecole Polytechnique Federale de Lausanne, a master's degree from Colorado State University and a bachelor's degree from Polytechnic University of New York . He originally came to Motorola in 2004. According to a story in Mass High Tech,

... he was responsible for the company's (Motorola) corporate strategy and technology agenda, including the oversight of venture investments and acquisitions.During his tenure at Motorola, the company made a number of high-profile acquisitions including Good Technology and Symbol Technologies. Before working at Motorola he was vice president and general manager of Vitesse Semiconductor Corporation after its merger with Multilink Technology Corporation. He was a co-founder and chief executive of Multilink. Prior to Multilink, he worked with ATT Bell Laboratories.

Sonus continues to perform reasonably well. It's latest first quarter results which took place in a difficult market were better than acceptable.

Revenues for the first quarter of fiscal 2008 were $74.0 million, compared with $97.1 million in the fourth quarter of fiscal 2007 and $71.1 million for the first quarter of fiscal 2007. Net income on a GAAP basis for the first quarter of 2008 was $0.6 million, or $0.00 per diluted share, compared to GAAP net income of $14.1 million, or $0.05 per diluted share, for the fourth quarter of 2007, and a GAAP net loss of $4.0 million, or $0.02 per share, for the first quarter of 2007.Nottenburg can be expected to hit the ground running. He will also be appointed a member of the company's board. The company is not in serious difficulty and its future prospects appear positive. One can assume Nottenburg will try and play off his vast connections in the technology sector to bring new impetus to the firm.

Keep a close eye on his first six month decisions and business moves. Be assured that Hassan Ahmed will be watching closely.

For more:

Chicago Business

Techland

TMC Net

Labels:

Hassan Ahmed,

New CEO,

Richard Nottenburg,

Sonus Networks

Tuesday, May 20, 2008

Recommended Reading - Reputation and Crisis Red Flags

Dr Leslie Gaines-Ross, who authors the reputationXchange.com, wrote a blog piece the other day that briefly examined the list of crises put out each year by the Institute of Crisis Management. She summarized the results of the study as follows:

In 2007, ICM found that over half (52%) of major crises were caused by management. Employees accounted for 29% of crises in 2007 and outside forces contributed to the remaining 19%.Check out her work and the actual study by the Institute of Crisis Management.

Recommended Reading - Franklin Bank Sacks CEO

Peter Moreira of the Deal.com wrote a story today on the sacking of the Franklin Bank's CEO, Anthony Nocela. Franklin Bank FBTX (NASDAQ) was originally founded by Lewis Ranieri one of the founders of the mortgage securitization business.

There is probably a lot more than meets the eye with this change. Floyd Norris of The New York Times also wrote an interesting piece on the change and the problems the bank is facing.

For more:

Monday, May 19, 2008

CEO Watch - Alcatel-Lucent, Patricia Russo, Update 4

Is there more bad news for Patricia Russo, CEO of Alcatel-Lucent? For months now I have been writing about Russo as one of the top CEOs at risk for their position. Carol Matiack wrote a piece in Business Week that focused on a proposed rule change to be voted on by shareholders,

at their annual meeting on May 30, shareholders of the world's largest telecommunication equipment maker will vote on a resolution that would allow the board to remove the CEO or chairman by a simple majority vote, instead of two-thirds as currently required.

Matiack went on to write,

... Against that backdrop, the proposed bylaws change looks ominous for Russo. Alcatel-Lucent said in a statement that the existing two-thirds majority rule, put in place at the time of the merger, was intended as a temporary measure "to enhance the stability of the senior management during the inevitably difficult transition period." But the provision was to have stayed in place for three years—and now the board likely will jettison it after only 18 months.

We will just have to wait and see what happens with the vote and whether it will ultimately result in Russo's undoing.

Dell Reshuffles the Deck - Bringing in New CFO

Dell Computer Dell (NASDAQ) is reshuffling some chairs again. Today, the company announced,

... Brian Gladden will succeed Don Carty, vice chairman and Chief Financial Officer, as senior vice president and CFO effective June 13, 2008. Mr. Carty has resigned, effective June 13. He will remain a member of the board of directors, which he joined in 1992.Mr. Gladden joins Dell May 20 as Senior Vice President and will assume the CFO role when Mr. Carty leaves on June 13. Reporting to Michael Dell, CEOand chairman, Mr. Gladden will be responsible for all aspects of Dell’s finance function including accounting, financial planning and analysis, tax, treasury, audit, and investor relations.Prior to joining Dell, Mr. Gladden was President and Chief Executive Officer of SABIC Innovative Plastics Holding BV, formerly GE Plastics, and among the world's largest producers of high-performance polymers used by electronics, office equipment, computer, and automotive manufacturers.

As Hewlett Packard HPQ (NYSE) continues to shine and now is working to acquire EDS, Dell finds itself under increasing pressure once again. The Gladden appointment

looks good on paper but it is worrisome that Carty is leaving after only seventeen months under his belt at the firm. Carty was originally hired to help the company through an internal investigation of the company's accounting practices. Alexei Oreskovic in a story for

TheStreet.com referred to

Dell spokesperson Jess Blackbrun who indicated,

the switch was planned and expected by Dell and Carty, following the completion of the accounting probe late last year."It never really was intended for him to stay on the role for an extended period," said Blackburn.

I have no prior knowledge but I am suspect of the explanation. Keep a close eye on Gladden and Dell in particular.

For more:

Friday, May 16, 2008

Recommended Reading - Haunting G.E. and A.I.G.

Yesterday Jeffrey Cane wrote a clever little piece in Portfolio.com on G.E. and A.I.G's former CEOs who have managed recently to give their predecessors further heartburn as they struggle with their current positions. At a minimum, the piece is worth a good chuckle. Check it out.

Labels:

A.I.G.,

G.E.,

Hank Greenberg,

Jack Welch,

Jeffrey Immelt,

Martin Sullivan

Thursday, May 15, 2008

Recommended Reading - Rough economy cuts into pay for U.S. CEOs: study

Mercer Consulting released a study today that examined CEO compensation for Fortune 1000 companies. According to a Reuters story by Martha Graybow the study found,

CEO compensation at the biggest U.S. corporations dropped sharply last year, reflecting in part the rough business conditions at top-tier banks and other large financial firms.... The study found that the CEOs of 50 large U.S. companies -- companies with median annual revenue of $66.2 billion -- took the sharpest cut in total direct compensation in the last fiscal year on a percentage basis, down 15.8 percent from the previous year.

As CEO compensation continues to be a controversial topic, it is likely the study may find itself enmeshed in the political process and the upcoming presidential elections. Check it out.

For more:

Wednesday, May 14, 2008

CEO Watch - Hector Ruiz, CEO AMD, Update 6

The saga endures. AMD, the semiconductor laggard, continues to re-shuffle the deck while avoiding the captain at the top. Monday, AMD announced a series of major executive changes in another attempt to right the ship, save money and get their new products out on time and selling. According to James Morris who wrote a story for Custom PC,

AMD may not have the upper hand in the processor business, but it’s shaping up to be the king of ‘organisational and executive changes’. After denying it was laying off 5 per cent of its workforce in March, the company went on to make double that number redundant. Now, as part of ‘ongoing efforts to re-architect its business for sustained profitability’, AMD has created a Central Engineering section.According to Joel Hruska who wrote a piece for Ars Technica,

AMD is pushing ahead with its plans to restructure the company and cut costs as part of an overall goal to return to profitability by the second half of this year. The company announced several executive-level layoffs reorganizations ...Jennifer LeClaire of CIO magazine chimed in. She wrote,

Departing figures include Mario Rivas, former executive VP of the Computing Solutions Group, and Michael Cadieux, former senior vice president and Chief Talent Officer...

As part of the shuffle, 24-year AMD veteran Randy Allen is changing hats. Allen was most recently responsible for AMD's server and workstation division and previously oversaw microprocessor engineering, including the successful introductions of the AMD Opteron and AMD Athlon 64 processors.

In his new role as senior vice president of the computing solutions group, Allen reports directly to Meyer and is responsible for the development and management of AMD's portfolio of consumer and commercial microprocessor solutions and platforms. Mario Rivas, formerly executive vice president of computing solutions, has left the company to pursue other opportunities, according to AMD.All changes are commendable but would appear to be far too late. A number of analysts surmise the company is preparing itself for a sale. Stay tuned as Ruiz continues to shuffle the deck as the ship keeps taking on water. Could IBM or Freescale ultimately be in the picture? The new employees hail from these firms.

... Meanwhile, the newly formed central engineering organization will be co-led by Chekib Akrout, who is joining AMD, and Jeff VerHeul, corporate vice president of design engineering at AMD. The central engineering leadership team will direct the development and execution of AMD's technology and product road maps in partnership with AMD's business units and will report directly to Meyer.

Labels:

AMD,

CEO Watch,

Chekib Akrout,

Hector Ruiz,

Jeff VerHeul,

Maria Rivas,

Michael Cadieux,

Randy Allen

Recommended Reading - 'Short Sellers' haven't had it so good since 1990

Alexis Xydias wrote a short story in Bloomberg today in which she talks about an analysis offered by Societe General's London based strategist James Montier. In the report Montier wrote,

"The opportunities are on the short, not the long side," Xydias went on to quote him further, "Perhaps it is time to join the dark side" (referring to short sellers).I bring up the issue of shorting because it often can play an important role when examining "significant" management change at a company. To state the obvious, one should always examine management change from a variety of angles.

Tuesday, May 13, 2008

Recommended Reading - Dutch move to limit big payouts for chief executives

The egalitarian Dutch are the first to try and limit big payouts to executives. According to a story by Stephen Castle in the International Herald Tribune the Dutch are working on ways to curb executive excess as it relates to money.

... the government is backing an unusual law that takes a first crack at curbing such windfalls. The legislation, drafted by the finance minister, Wouter Bos, was sent to Parliament on Tuesday, where it is expected to pass in time to come into force next year."I believe cohesion in society is not served by inexplicable inequalities," Bos said at a recent seminar of center-left politicians, held at a country-house hotel north of London. "Public support for entrepreneurship around the globe is eroded if you let this continue, and this is not in the interests of our economy or entrepreneurship."

If you happen to be interested in executive compensation no matter which side of the argument you are on you should read the article and keep a close eye on how The Netherlands handles the proposed changes.

Labels:

Executive Compensation,

Pay Limits,

The Netherlands

Monday, May 12, 2008

Former CEO Children's Place Has Finally Got the Attention of The Firm

Ezra Dabah the former CEO of troubled children's retailer, A Children's Place PLCE (NASDAQ), and its largest shareholder appears to have finally gotten the attention of the public company. I have been following Dabah's attempts for some time in the blog. After continuing efforts to get the company to consider Dabah as a possible acquirer of the firm after his initial ouster back in September 2007, the board has finally responded to his requests. In an Associated Press story by Amanda Fehd in the Atlanta Journal Constitution Fehd wrote,

The board of Children's Place Retail Stores Inc. said Friday it has approved a request from its former chief executive Ezra Dabah to work on a proposal to acquire the company with a private equity firm.Dabah had asked the board's permission to bypass shareholder acquisition laws that could otherwise preclude Golden Gate Private Equity Inc.'s participation in an offer.

Children's Place continues to struggle in the midst of a difficult retailer environment and a decline in the company's cache as a moderate priced but high styled children's clothing store. Keep a close eye on how this all plays out.

For more:

Labels:

Buyout Offer,

Children's Place,

Ezra Dabah,

Former CEO

Recommended Reading - Private Company Facebook Losing CFO

I do not typically comment or cover management changes at private companies but the recent news that 23 year old CFO, Adam D'Angelo, is leaving Facebook is worth a quick note. Kara Swisher of All Things Digital wrote a story yesterday confirming rumors that D'Angelo was leaving.

D’Angelo wrote a letter to Facebook staff on Friday about the move. He said he wanted a break.But, according to sources close to the company, D’Angelo felt his responsibilities no longer fit well with his skills and interests.

Dealbreaker earlier today wrote a short piece in which it surmised,

... Lately the company has been bringing in more mature talent, many from Google, so there seems to be a out-with-the-young in-with-the-seasoned trend afoot.It can not be easy for a twenty three year old to serve as CFO for a company like Facebook.

For more:

Friday, May 9, 2008

CEO Watch - Martin Sullivan, AIG

Back in early February I wondered if AIG's CEO, Martin Sullivan, might have been at risk for his job. At the time, the company's auditor Pricewaterhouse Coopers LLC, found "material weakness" in AIG's accounting for credit-default swap contracts that translated into a huge drop in the company's stock. Despite my blog post, I did not believe Sullivan should have been added to my CEO Watch list. Today, I am not so sure.

AIG's surprise announcement earlier today that it posted a $7.8 billion first-quarter loss has put Sullivan in a really difficult spot. According to a story by Colin Barr for Forbes,

AIG (AIG, Fortune 500) shares tumbled 9% Friday after the insurance giant posted a $7.8 billion first-quarter loss that was driven by another round of mark-to-market writedowns of mortgage-related positions. AIG said the latest quarter included a $5.9 billion pretax writedown of the value of the credit default swap portfolio held by its AIG Financial Products unit, and a $3.6 billion impairment of its mortgage-backed securities holdings.The spin is already on. Will shareholders and board members stay quiet as AIG (Sullivan) seems blind sided a second time in a row? We will just have to wait and see. For now, Sullivan stays on my CEO watch list. Keep a close eye on AIG and PR that comes from the firm.

For more:

CEO Watch - Philip Schoonover, Circuit City, Update 4

Circuit City appears to have made an about face today. The company announced it has hired Goldman Sachs to help with a potential. According to DealScape,

There is finally an agreement on the table between Circuit City and Wattles Capital Management LLC, and Circuit City has put itself on the block due to activist pressure, hiring Goldman, Sachs & Co. to manage the sale.Blockbuster must be happy about the announcement. One can only assume that Circuit city CEO, Philip Schoonover, recognized the need to try and play ball with Wattles, Blockbuster and Carl Ichan. Time will tell how all this plays out. According to the New York Times Deal Book, Ciruit City's change of heart might be due to,

Why the change? A letter from the billionaire investor Carl Icahn, who is Blockbuster’s largest shareholder, seemed to be a major factor. Circuit City said that Mr. Icahn had pledged, with certain conditions, to buy the company on his own if Blockbuster should be unable to finance the deal. “This written commitment answers some of [the company’s] questions with regard to Blockbuster’s and Mr. Icahn’s previous disclosures,” Circuit City said in a news release.

Keep your ears to ground and stay tuned. There is more to come.

For more:

Credit Crisis - Corporate Governance = Splitting of CEO and Chairman, Wachovia

Yesterday, Wachovia WB (NYSE) took the Chairmanship away from Kennedy Thompson the bank's CEO. The change came shortly after the company's loss was twice as large as expected. Thompson finds himself in real hot water. The credit crisis contin ues to impact the bank. According to a story by David Mildenberg for Bloomberg,

ues to impact the bank. According to a story by David Mildenberg for Bloomberg,

ues to impact the bank. According to a story by David Mildenberg for Bloomberg,

ues to impact the bank. According to a story by David Mildenberg for Bloomberg,"Ken Thompson is in a very hot seat,'' said Jaime Peters, an analyst at Morningstar Inc. "People are starting to call for his head the same way that they were calling for Chuck Prince's at Citigroup,'' Peters said, alluding to how Citigroup Inc. replaced CEO Charles O. Prince after posting a record-fourth quarter loss. Morningstar rates Wachovia at three out of five stars, similar to a hold rating, she said.The bank's lead independent director, Lanty Smith, assumed the chairman's position. While the change meets with standard governance requirements, I am skeptical it will make a real difference in the running of the bank. Smith is known as a recent supporter of Thompson. According to story by Rick Rothacker in the Charlotte Observer,

The change elevates a director who has stood behind Thompson in recent weeks -- and who has also faced criticism himself. The shift comes at a critical time for Thompson, the bank's CEO since 2000 and a fixture on the Charlotte civic scene.Smith has said in recent weeks that Thompson has the board's full backing. The bank said neither was available for comment Thursday. Asked whether the move signaled any change in the board's confidence in Thompson, Phillips-Brown noted that he maintains all of his duties running the company.In his role as lead independent director, Smith assisted the chairman, approved meeting agendas, served as a liaison between independent directors and ran any meetings in which the chairman wasn't present. Now, as non-executive chairman, he will be in charge of all board matters and preside over its meetings.Smith has served on the board since 1987, taking the lead director spot in 2000. He is also chairman and CEO of a Raleigh merchant bank. While Thompson has absorbed most of the heat during the bank's recent travails, Smith also has come under attack.

The only good news for Thompson is he is smart enough to read the tea leaves and can be expected to work hard to save himself and the bank. The splitting of the chairmanship and CEO positions in this situation is just window dressing and should give Thompson more time to save himself. According to a story in the Atlanta Business Journal,

Nell Minow, co-founder of The Corporate Library, a research firm specializing in corporate governance, said proposals to split the chairman and CEO roles often come up at companies that have encountered problems."In companies where the shareholders have lost some confidence, that is one of the go-to strategies for change," she said. "It's a way for shareholders to begin a very important conversation. It gets people's attention.

We will just have to wait and see what happens over the next few months.

For more:

Thursday, May 8, 2008

CEO Watch- Sir Stuart Rose, Marks and Spencer

Marks and Spencer MKS (LSE) the well-known United Kingdom mid-priced department store company has been embroiled in a governance/top executive controversy. The company's highly regarded CEO, Sir Stuart Rose, recently (March 10 annou ncement) added the executive chairman title while remaining the firm's CEO. Rose is expected to give up his CEO title in 2011. The dual title promotion is a direct violation of one of the UK's governance regulations. Sir Rose was originally brought in to serve as the company's CEO back in 2004, when Marks and Spencer was expected to become a hostile takeover target of well-known British retailer/money man Philip Green. Rose out manuveured Green. According to a BBC story,

ncement) added the executive chairman title while remaining the firm's CEO. Rose is expected to give up his CEO title in 2011. The dual title promotion is a direct violation of one of the UK's governance regulations. Sir Rose was originally brought in to serve as the company's CEO back in 2004, when Marks and Spencer was expected to become a hostile takeover target of well-known British retailer/money man Philip Green. Rose out manuveured Green. According to a BBC story,

ncement) added the executive chairman title while remaining the firm's CEO. Rose is expected to give up his CEO title in 2011. The dual title promotion is a direct violation of one of the UK's governance regulations. Sir Rose was originally brought in to serve as the company's CEO back in 2004, when Marks and Spencer was expected to become a hostile takeover target of well-known British retailer/money man Philip Green. Rose out manuveured Green. According to a BBC story,

ncement) added the executive chairman title while remaining the firm's CEO. Rose is expected to give up his CEO title in 2011. The dual title promotion is a direct violation of one of the UK's governance regulations. Sir Rose was originally brought in to serve as the company's CEO back in 2004, when Marks and Spencer was expected to become a hostile takeover target of well-known British retailer/money man Philip Green. Rose out manuveured Green. According to a BBC story,At the time, the High Street icon was in deep trouble, losing market share to hipper and cheaper rivals and fending off a hostile takeover bid from Arcadia's owner, retail tycoon Philip Green.In a dramatic boardroom shake-up, M&S replaced embattled chief executive Roger Holmes with Sir Stuart.He immediately unveiled an ambitious turnaround strategy that involved buying the women's fashion brand Per Una from its creator George Davies and selling the firm's financial services division to focus on the chain's core business - women's fashion.But the challenge was tough and analysts were sceptical.Successful mission?With half-year profits at M&S up 11% at £451.8m for the six months to the end of September, despite a wet summer and higher interest rates dampening consumer spending, it is generally accepted that Sir Stuart has, in three years, put M&S firmly back on the map.

Rose appears to recently have put pressure on Mark's and Spencer's board. Either they gave him the dual role or he would leave as of 2009 as originally planned. With no apparent successor in place and a retailing environment that appears to be getting worse, the board apparently decided they would be better off defying governance requirements and keeping Sir Rose happy. In a March 15, 2008 Economist story entitled, A Rose by any other name; Shake-up at Marks and Spencer the story stated,

... M&S board members say they had to agree in order to keep him around beyond 2009, when his existing contract runs out. Sir Stuart is credited with engineering the dramatic improvement in the retailer's performance from 2004, and with tougher times looming his fans were loth to let him go.

Shortly after this decision was made public, a number of large investors expressed their displeasure with the decision despite a recognition of the retailing talents Sir Rose has shown throughout his executive reign at the firm and in the past. The Economist story went on to state,

Investors, however, are furious. Legal & General, an insurer, frets that his promotion is a "potentially damaging concentration of power". The Association of British Insurers, which represents many large investors, has demanded an explanation.Shareholder unease comes at an awkward time for the firm. After nine quarters of steadily improving sales, M&S stumbled over Christmas. In January it said that in the last quarter of 2007 sales in stores that had been in existence for at least 12 months slumped by 2.2% from a year earlier, and clothing sales by 3.2%. Same-store sales at rivals rose, however, and retail sales in general were 3.7% higher in December. M&S shares have fallen by 31% this year, compared with 20% for the retailing sector.

At first, the company seemed to be defiant but after the controversy continued the company made what might be considered small concessions to allay the concerns of major investors. It is difficult to tell whether the changes will be sufficient and whether Sir Rose will be happy over time with them. According to BreakingNews on April 3, 2008,

... The retail giant is said to have drafted a letter to shareholders spelling out measures to win backing for Rose's move to the post of executive chairman. It is understood that M and S will propose that Rose stands for re-election every year, which will allow shareholders to vote on his appointment at this year's annual general meeting in July. The group will also reportedly pledge not to give Rose a pay rise and look to appoint a senior independent director to ensure his influence is kept in check.

The real issue that remains is whether Sir Rose is too strong and as a result could impose changes that might not get sufficiently vetted in advance from a board that is outgunned and controlled by Sir Rose.

Keep a close eye on moves and results related to Marks and Spencer for next number of months.

For more:

Recommended Reading - Merrill, Citi chiefs tap former employers

Wednesday May 7th's Financial Times had an intriguing article by Ben White that examined Cit and Merrill's new CEOs' attempts to hire top talent from their previous employers and re-shape their firms accordingly.

... The moves have been controversial within both banks, with incumbent executives pushed out or moved into new roles.At Merrill, John Thain has hired a string of former Goldman executives including Peter Kraus to head strategy, Thomas Montag to run global sales and trading, and Noel Donohue to co-head risk management. Some on Wall Street have taken to referring to the bank as Merrill Sachs.... At Citigroup, Vikram Pandit has hired several former colleagues at Morgan Stanley, including John Havens as chief executive of the investment bank and hedge fund businesses; Don Callahan as chief administrative officer; and Brian Leach as chief risk officer.

The piece is a worthwhile quick read.

Also Read

Wednesday, May 7, 2008

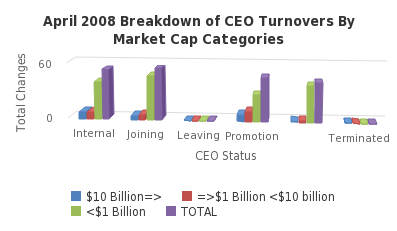

April CEO Turnover Numbers By Market Cap

Below find a graphical representation of CEO turnover derived from Liberum Research's Management Change Database for the month of April 2008. The graph is broken down into three market cap categories:

> Companies with Market Caps => $10 billion

> Companies with Market Caps => $1 billion < $10 billion

> Companies with Market Caps => $10 billion

> Companies with Market Caps => $1 billion < $10 billion

> Companies with Market Caps < $ 1 billion

Tuesday, May 6, 2008

CEO Watch - Jerry Yang, Yahoo

The rumors are beginning to fly now that Microsoft has walked away from Yahoo. Today Zachary Kouwe wrote a piece in the NY Post entitled, Investors May Yank Yang, Filo over Dough. According to the story,

For more:

International Herald Tribune

Newsfactor

Several hedge funds with large positions in Yahoo! have written letters to the board and to Yahoo! President Sue Decker explaining their displeasure at how Microsoft's hostile offer was mishandled, sources close to the funds said.The dance is probably not over with Microsoft. For now, Yang will need to find ways to convince shareholders Yahoo can turn itself around, a tall order. According to an AP story on MSNBC Yang is still open to working out a deal with Microsoft.

Shareholders are particularly irked that Yang and co-founder David Filo negotiated with Microsoft last weekend without any representative from the board or their advisers.

If Microsoft returned with a “real offer and a real proposal,” Yang said, “we would be happy to listen.”Reuters Deal Zone quotes The New York Times and Wall Street Journal,

Yang figures to get an earful from irate shareholders at the annual meeting. Yahoo finally set the meeting for July 3 after indefinitely postponing it in early spring as part of its effort to foil a possible hostile takeover attempt by Microsoft.

Now it may be Yahoo’s shareholders who try to oust Yang and the rest of Yahoo’s board instead of Ballmer, who had threatened an attempt to dump the 10 directors if they didn’t accept Microsoft’s offer.

“I am extremely angry at Jerry Yang and at the so-called independent board,” Crawford told the Times. ”I’m hoping that there is such an outpouring of outrage that the board is embarrassed into revisiting this thing … but I’m not optimistic about that.”I don't think Yang is on the way out but we will just have to wait and see how this all plays out.

For more:

International Herald Tribune

Newsfactor

Labels:

CEO Watch,

David Filo,

Jerry Yang,

Microsoft,

Steve Ballmer,

Susan Decker,

Yahoo

Long-time Chairman and CEO of Applied Signal Technology Resigns

Last Thursday Applied Signal Technology APSG (NASDAQ) announced that its long time CEO and chairman, Gary Yancey, had resigned and will be leaving the company effective May 30, 2008. He will also be leaving the company board. Yancy co-founded the company. H e has served as the chairman and CEO since 1984. The company has chosen William Van Vleet III, the chief operating officer to serve as interim CEO until a permanent successor is chosen. The company also named John Devine, a company director since 1995, non-executive director effective May 1. According to the company's SEC 8k filing,

e has served as the chairman and CEO since 1984. The company has chosen William Van Vleet III, the chief operating officer to serve as interim CEO until a permanent successor is chosen. The company also named John Devine, a company director since 1995, non-executive director effective May 1. According to the company's SEC 8k filing,

For more:

Mercury News

Forbes

e has served as the chairman and CEO since 1984. The company has chosen William Van Vleet III, the chief operating officer to serve as interim CEO until a permanent successor is chosen. The company also named John Devine, a company director since 1995, non-executive director effective May 1. According to the company's SEC 8k filing,

e has served as the chairman and CEO since 1984. The company has chosen William Van Vleet III, the chief operating officer to serve as interim CEO until a permanent successor is chosen. The company also named John Devine, a company director since 1995, non-executive director effective May 1. According to the company's SEC 8k filing,Mr. Van Vleet joined the Company in July 2005 as Executive Vice President of the Sensor Signal Processing Group in connection with the Company's acquisition of Dynamics Technology, Inc. and was promoted to Deputy Chief Operating Officer in August 2006 and Chief Operating Officer in November 2007. Mr. Van Vleet was President and Chief Executive Officer of Dynamics Technology, Inc. from 2002 to July 2005. Prior to that time, Mr. Van Vleet worked at The Boeing Company for 22 years, where he served in a variety of engineering management positions, most recently as the General Manager of the Communications, Information, and Oceanic Systems Division, and then leading efforts on the U.S. Missile Defense National Team as the Director of Battle Management, C2 and Communications.Often a sudden change at the top with no apparent successor to step in is viewed negatively. The change at Applied Signal, however, was a well overdue change and so far has been viewed kindly by the Street. The company provides advanced digital signal processing products, systems and services in support of intelligence, surveillance and reconnaissance for global security. It is time for new energy at the top of the firm. Keep a close eye on the moves the company takes over the next few months and who specifically they pick to succeed Yancy. The real question is whether they can bring in someone with the expertise to take the company to the next step.

For more:

Mercury News

Forbes

Monday, May 5, 2008

Recommended Reading - As if you didn't know by now, it's about the bottom line for CMOs

Jennifer Rooney of Advertising Age wrote a story today that examined the importance of sales/dollars for successful chief marketing officers. Liberum tracks CMOs and I thought the story might be of interest to investors focused on firms highly dependent on marketing.

CEO Watch - Steve Ballmer, Microsoft, Update 1

Could last week's story on Ballmer's fate actually have legs? Microsoft's withdrawal from the Yahoo takeover might put a bit more pressure on Ballmer. Yesterday Valleywag put out a piece questioning his long-term status. I remain skeptical but if interested check the story.

For more:

CEO Watch - Alcatel-Lucent, Patricia Russo, Update 3

Alcatel Lucent ALU (NYSE) has continued to disappoint. The company's latest earnings results remained negative and even below expectations. Alcatel-Lucent's C EO, Patricia Russo, remains on the hot seat. Today's Evan Newmark piece in the WSJ's Deal Journal examines the difficulty two large transnational companies face when they try to merge.

EO, Patricia Russo, remains on the hot seat. Today's Evan Newmark piece in the WSJ's Deal Journal examines the difficulty two large transnational companies face when they try to merge.

EO, Patricia Russo, remains on the hot seat. Today's Evan Newmark piece in the WSJ's Deal Journal examines the difficulty two large transnational companies face when they try to merge.

EO, Patricia Russo, remains on the hot seat. Today's Evan Newmark piece in the WSJ's Deal Journal examines the difficulty two large transnational companies face when they try to merge. The integration of the two companies hasbeen painful. ... A clash of cultures and personalities is inevitable. Yet, a year or so into these deals, you always hear about “underestimating the difficulties of integration.”At Alcatel-Lucent, the senior management team chart from the “Day One” Investor Presentation was a labyrinth of reporting lines and 24 smiling European and American faces. I am surprised investors didn’t run screaming from the room when that slide was put up. In the first year of the combination, Russo lost three of the company’s top executives, including President Mike Quigley and Chief Financial Officer J.P. Beufret, both highly regarded by investors.

Newmark examines whether Russo is at fault for the problems or whether there is far more to the problem. Considering Russo's results so far, she must bear a large portion of the problems. I remain skeptical about her staying power at the top of the firm. Keep a close eye on what happens.

Labels:

Alcatel-Lucent,

CEO Watch,

Deal Journal,

Patricia Russo

Friday, May 2, 2008

CEO Watch - Steve Ballmer, Microsoft?

Steve Ballmer, the larger than life CEO of Microsoft who is frequently seen ranting and yelling in his presentations, recently was the focus of a Wired story. Wired has raised the question whether Ballmer might be at risk for his position. While the supposition might seem far fetched at this moment, Wired talks about the troubles surrounding Microsoft's launch of Vista as well as the ongoing fight to acquire Yahoo. There is some merit to the idea but it is very unlikely. Just yesterday Mary Jo Foley on CNET's blog wrote a short piece in which she tried to examine who Microsoft could turn to should Ballmer go.

For more:

Recommended Reading - California Leaving: Calpers Loses Top Talent

Maurna Desmond wrote a story in Forbes on the recent spate of top talent exits at California's Public Employment Retirement System (CALPERS), the nation's largest public pension fund.

Fred Buenrostro, chief executive officer of the California Public Employees' Retirement System for more than six years, said late Monday he would leave to pursue opportunities in the private sector. The news comes just days after Chief Investment Officer Russell Read announced his resignation in order to pursue opportunities in green investments.

The timing sounds fishy, but Calpers' board president, Rob Feckner, says it isn't. "It's best to go out when you're on top. It's called marketability."

What could all this mean for Calpers and where is Buenrostro going? Check out the story.

Labels:

Calpers,

Fred Buenrostro,

Russell Read,

Talent exits

Subscribe to:

Posts (Atom)