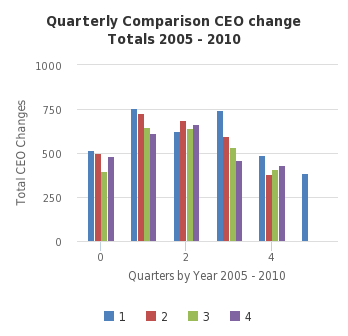

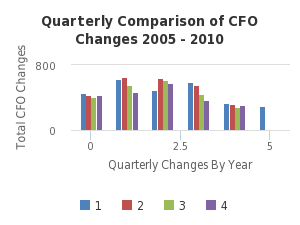

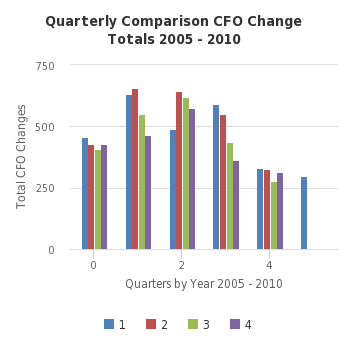

Executive turnover has continued to decline throughout the great economic recession. Liberum’s latest quarterly turnover numbers for CEOs, CFOs, Board of Directors and C-level executives (defined to include CEOs, board of directors, CFOs, COOs, down to VP level) continued to show a drop in turnover for all key categories for the first quarter of 2010. This declining trend in executive turnover has continued since the first quarter of 2008 for all key executive turnover categories (see the CEO, CFO and C-level graphs below for quarterly turnover comparisons). For the first time since early 2008, Liberum expects the declining trend in executive turnover to have bottomed. We expect to see turnover numbers to begin to increase as we move into the second quarter of 2010.

While the first quarter of 2010 continued to show significant declines in executive turnover when compared with the first quarter of 2009, we have finally seen the overall executive turnover declines slowing when the figures are compared with the last quarter of 2009. If this trend continues, increased executive change at the top of companies may actually mean the economy is in for real expansion and growth.

GRAPHICAL REPRESENTATION OF QUARTERLY EXECUTIVE TURNOVER 2005 - 2010